Introducing the Self-Employed Tax Credit (SETC)

You may be eligible for up to $32,220 in tax credits from 2020 & 2021

Takes 5 minutes to see if you qualify

NO UPFRONT FEES

This is NOT a loan

It is NOT taxable

It does NOT have to be paid back!

The SETC is a specialized tax credit designed to provide support to self-employed individuals during the COVID-19 pandemic.

It acknowledges the unique challenges faced by those who work for themselves, especially during times of illness, caregiving responsibilities, quarantine, and related circumstances. This credit can be a valuable resource for eligible individuals to help bridge financial gaps caused by unforeseen disruptions.

Almost everybody with Schedule C

income qualifies.

Amidst the pandemic, millions grappled with COVID-related challenges, including illness, symptoms, quarantine, and caregiving responsibilities. If you found yourself in such situations, where COVID impacted your ability to work, the SETC was designed to be your safety net, but it’s not too late.

You may be eligible for up to $32,220 in tax credits from 2020 & 2021

Self-Employed Status:

If you were self-employed in 2020 and/or 2021, you could potentially qualify for the SETC. This includes sole proprietors who run businesses with employees, 1099 subcontractors, and single-member LLCs. If you filed a “Schedule C” on your federal tax returns for 2020 and/or 2021, you’re on the right track.

COVID Impacts:

Whether you battled COVID, experienced COVID-like symptoms, needed to quarantine, underwent testing or cared for a family member affected by the virus, the SETC could be your financial relief. If the closure of your child’s school or daycare due to COVID restrictions forced you to stay home and impacted your work, we’re here to help.

Get Started With Your Application Today

We’ve partnered together

To bring you a seamless submission experience for your SETC application.

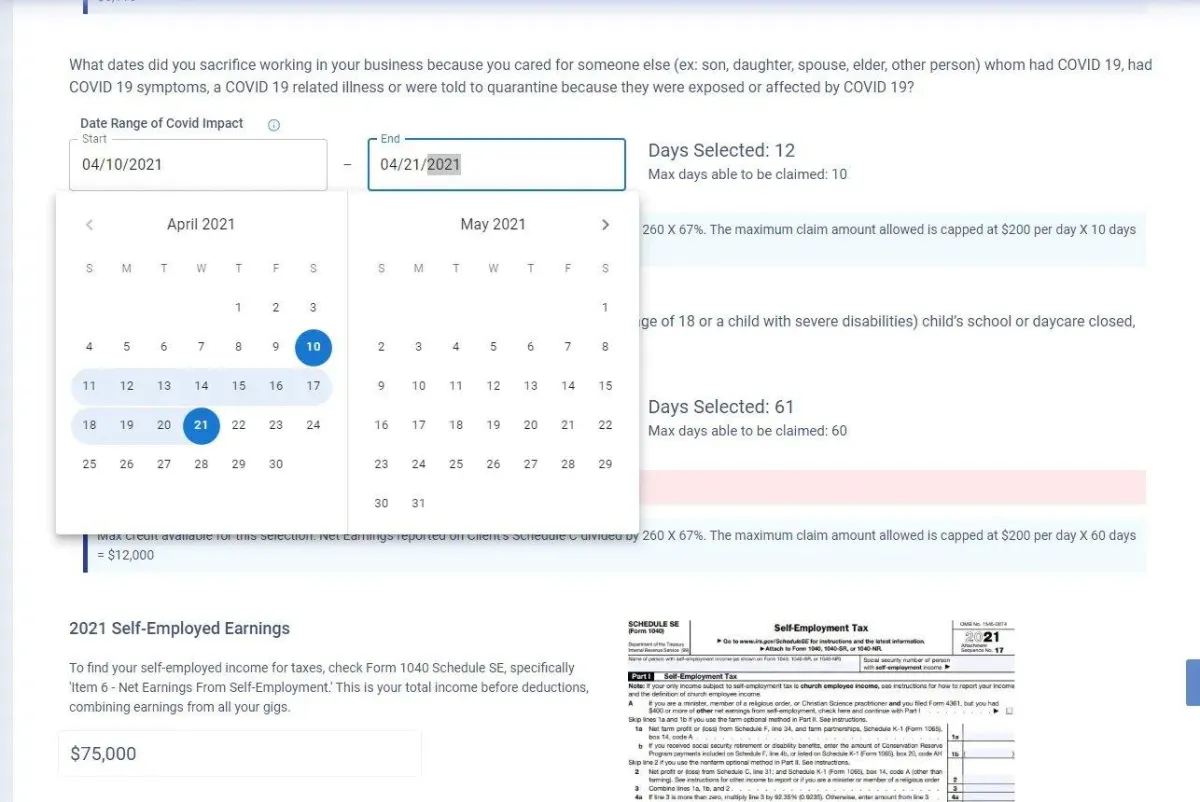

Simply enter any disruptions to your business due to COVID-19 during 2020 and/or 2021.

If you experienced any COVID-related disruptions to your business, you could qualify for the SETC. This includes illness, symptoms, quarantine, testing, and caregiving responsibilities. If you were forced to stay home due to the closure of your child’s school or daycare, you could qualify as well.

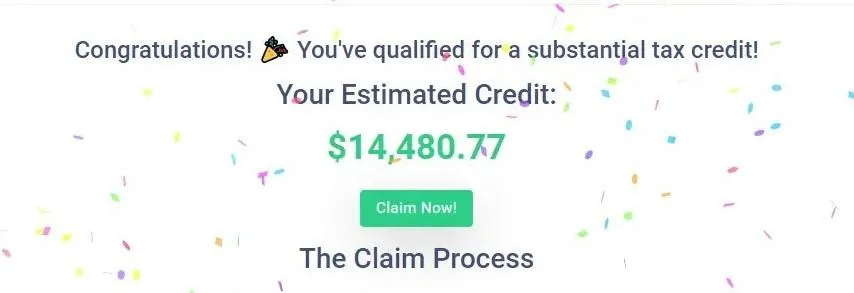

Calculate and discover your potential tax credit amount.

Discover how much you could receive in tax credits by entering your information into our calculator. You could recover up to $32,220 in tax credits from 2020 and 2021!

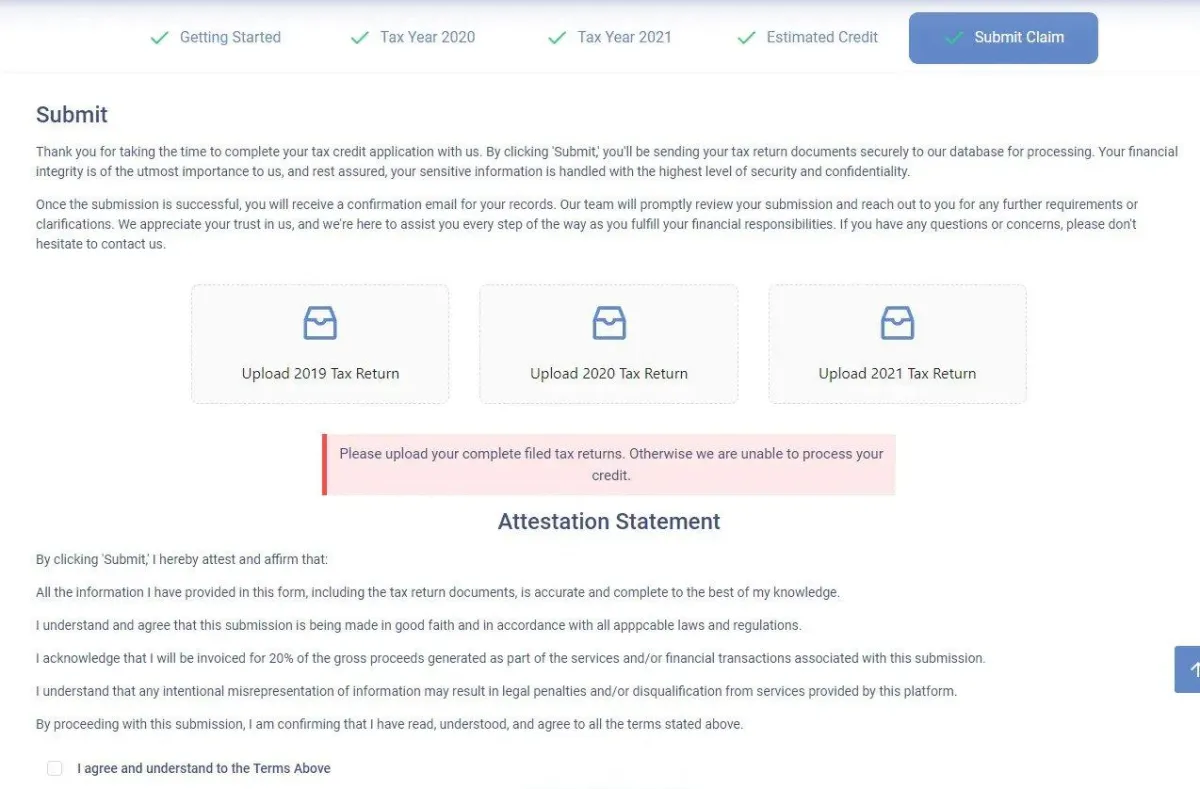

Submit your tax returns, and Fundable will do the rest.

Fundwise team of tax professionals will review your application and submit it to the IRS on your behalf. If you qualify, you'll receive your tax credit in the form of a refund or a reduction in your tax liability. If you don't qualify, you won't pay a dime.

Need help completing the application?

The application process is quick and efficient, consisting of just six questions. Rest assured that we understand the importance of your time, which is why we've designed a streamlined process that will guide you through each question with ease. Our user-friendly interface ensures a hassle-free experience, making it convenient for you to complete the application in no time. So sit back, relax, and let us handle the rest.

What documents are required?

The application process is quick and efficient, consisting of just six questions. Rest assured that we understand the importance of your time, which is why we've designed a streamlined process that will guide you through each question with ease. Our user-friendly interface ensures a hassle-free experience, making it convenient for you to complete the application in no time. So sit back, relax, and let us handle the rest.

Watch How To Apply

Get An Online Quote Instantly After Submitting Your Details

Helping Small Business Owners Grow